US Life Sciences Transactions 2020

October-December | July-September | April-June

Below are charts summarizing the number of US Life Sciences transactions compiled from Pitchbook* over the course of calendar year 2020, and our assessment of the activity in the sector. Each quarter, the Mintz Life Sciences team will update the data to include a new quarter of transactions data and analysis. As the data set builds, we will provide insights gleaned from a review of the data and our experience in the industry.

4th Quarter Demonstrates Stable Progress in the Life Sciences

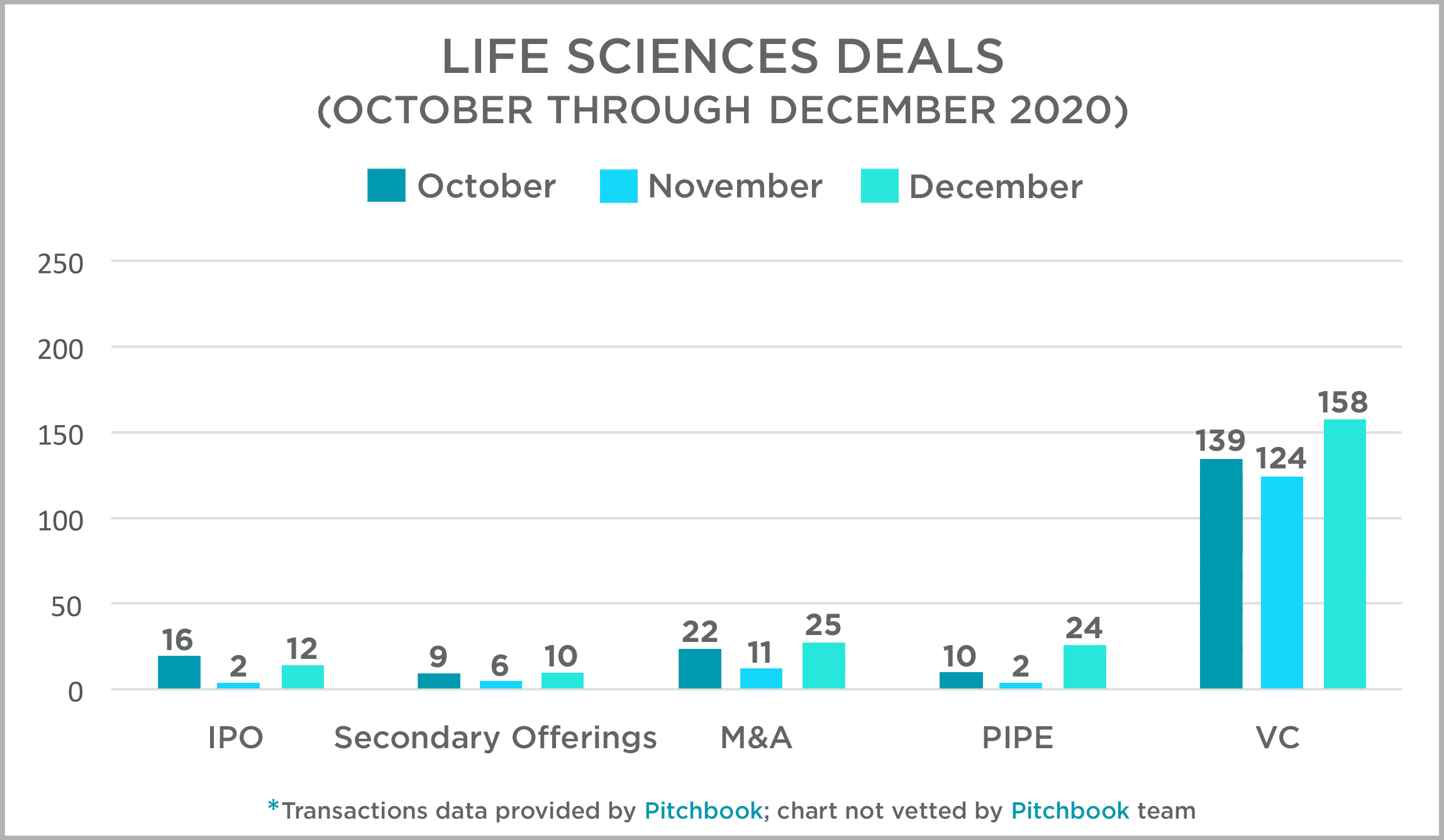

During the 4th quarter, November observed low activity across the board. PIPE transactions remained healthy. However, total PIPE activity decreased 33% due to the low November performance in the life sciences industry.

Venture capital activity remained stable as well. Despite a total decrease in activity by 31%, the numbers for this quarter match the usual VC deal flow in the life sciences industry. The previous quarter displayed strikingly high activity in July with 204 deals, causing the unusual variation in data. The 3rd quarter ended on a high note, with the most activity in December 2020. Early and later stage VC subcategories were the leaders in deal flow with a month to month upward trend.

IPOs and mergers and acquisitions in the life sciences industry continued on a healthy trajectory. Despite lower total number of transactions in both categories, the difference was negligible. In addition, IPOs and mergers and acquisitions had a significant month-to-month fluctuation in the 4th quarter compared to the previous quarter. October IPOs began at 16 and then fell to 2 in November. Subsequently, December IPOs reached 12. Mergers and acquisitions in the life sciences industry was similar to IPO activity, with mid-quarter numbers dipping in November and then recovering in December.

Secondary offerings grew in the 4th quarter. Mid-quarter activity increased, with 6 secondary offerings in November. Most notably, total secondary offerings went up by 25% from the 3rd quarter.

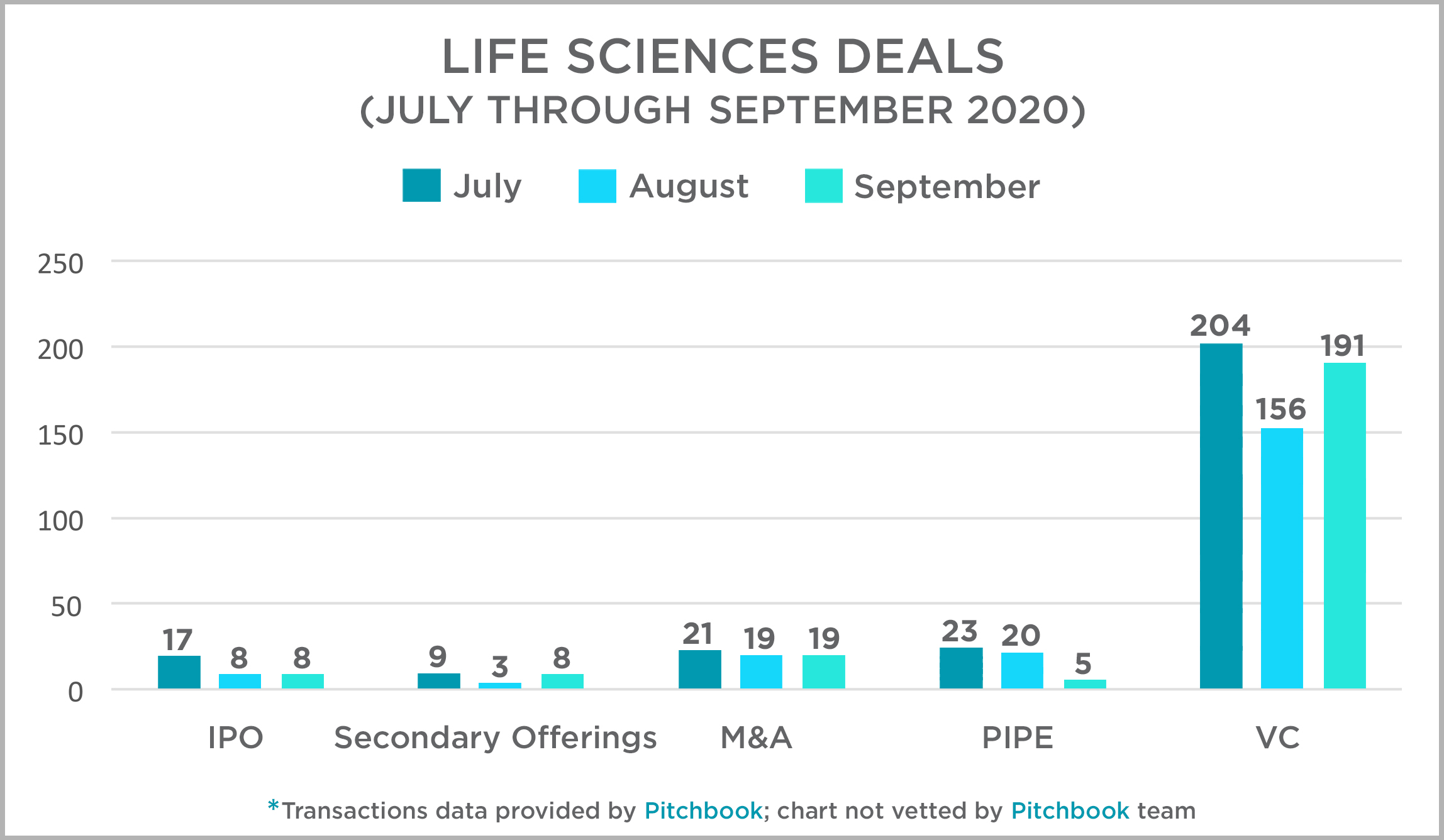

3rd Quarter – the second of the COVID-19 era – Shows Continued Promise for Life Sciences

In this 3rd quarter, merger & acquisition activity was reportedly very high across many sectors, including automotive, retail, and consumer goods, reflecting both delayed deals from the prior quarter that had been stymied by the COVID-19–pandemic and consolidations brought on by the economic downturn. That same pattern did not hold true throughout the Life Sciences sector, where there was a reduction in the number of transactions from the 2nd quarter – though deal volume was not lacking as deals were surprisingly strong in the 2nd quarter.

Venture capital had an excellent quarter with a very significant 25% increase in deals over the 2nd quarter, representing investments across a healthy spectrum of companies working on therapeutic and diagnostic innovations. The largest percentage increase in deal volume was in PIPE transactions, with a 65% increase, although the numbers have reached a healthy level versus the prior 2nd quarter’s relatively lackluster showing.

Public offerings, inclusive of IPOs and Secondary Offerings, essentially broke even, with the market remaining fairly robust.

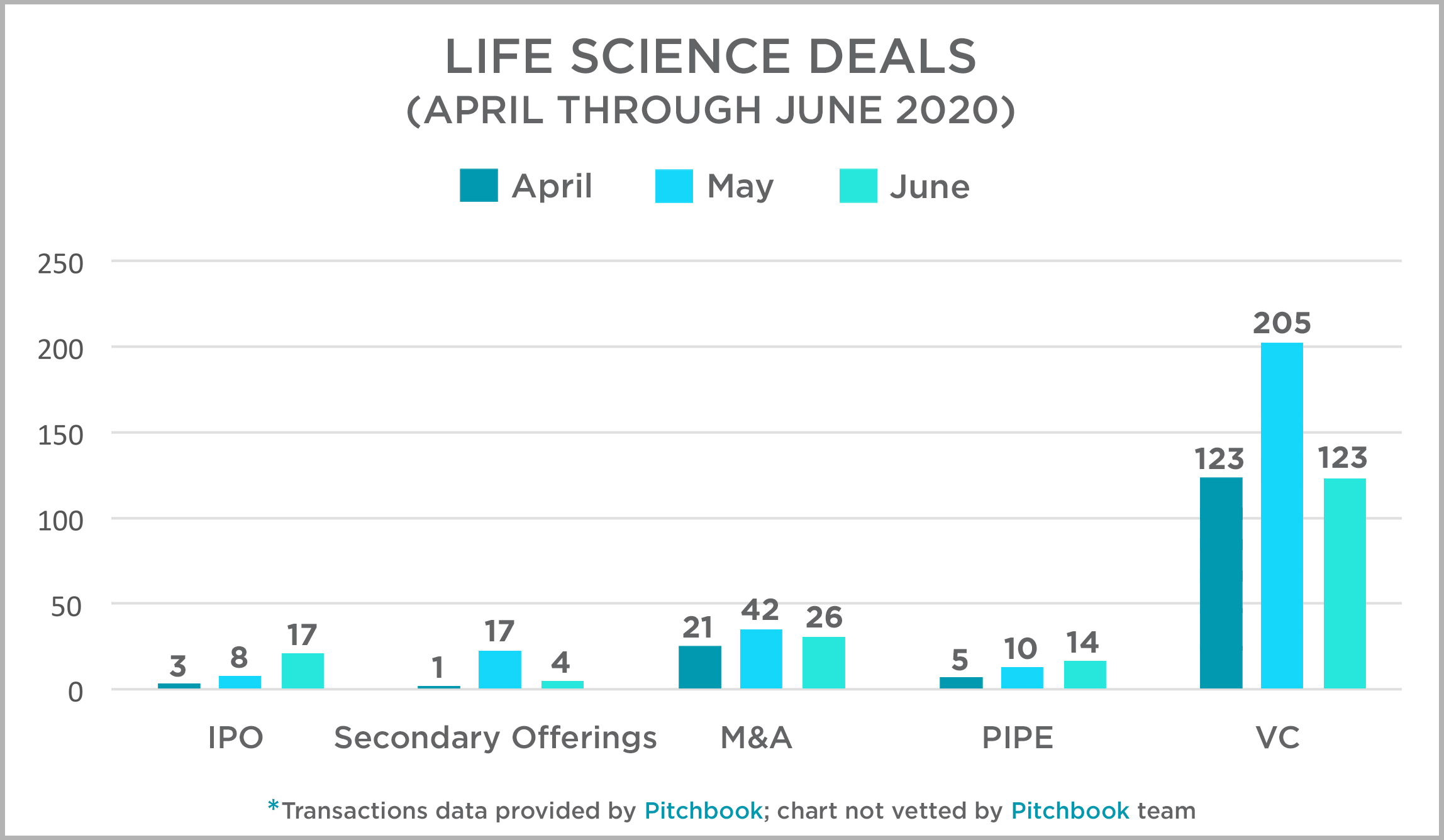

Interesting 2nd Quarter in Life Sciences

The 2nd quarter started off with most transaction categories nearly flat from the end of the prior quarter. That is not surprising, given the newness of COVID-19 at the time. May appears to have benefitted from some pent-up demand with an increase in public capital market transactions. Venture Capital saw a significant uptick as well in May. It was not entirely surprising to see a decline in June as we began to enter the summer months and uncertainties related to COVID-19 persisted. Our team is as curious as you to see how this summer shapes up in comparison to the spring – and also past summers. This far into the pandemic, the life sciences sector has outperformed other segments of the market. However, it will be interesting to see if the volume of COVID-19–related clinical trials begins to threaten or delay non–COVID-19 clinical trials, whether the persistence of the pandemic may negatively affect the launch of new products unrelated to COVID-19, and whether telemedicine will turn out to be a viable long-term solution to the inability of patients to see their doctors on a routine basis, as well as how these factors might affect collaborations, capital raising, and M&A in the life sciences sector for the foreseeable future.

A particularly positive data point from Dealogic, published by the Wall Street Journal on August 10, is that total IPO deal value for the biotech sector has achieved a record-breaking total — reaching higher already this year than achieved in the previous record year of 2018. While valuations are volatile, US biotech companies have raised roughly $9.4 billion in 2020 (through July) as compared to the full-year record set in 2018 of $65 billion.

*Pitchbook defines Life Sciences as including "companies involved in dealing with living organisms and life processes, including biology, pharmaceuticals, biomedical technology, and nutraceuticals."