Life Sciences Newsletter — September 2021

In this edition of the Mintz Life Sciences Newsletter, we share valuable insights from our colleagues in several legal and regulatory disciplines, provide insights into transactional and intellectual property activity in the life sciences industry, and profile work we have done for our life sciences clients.

Return to Work

Return-to-work plans are on everyone’s mind. And they present challenges for employers and employees alike. The Mintz Employment and Health Law teams have been keeping abreast of requirements and expectations, and providing guidance to clients. We continue to do so as conditions shift with the emergence of variants, new knowledge regarding the long-term efficacy of vaccines, booster recommendations, and more. See our “Emerging from the Pandemic” page with recent insights from our teams. We wish you and your family good health and a successful return to work and school.

Cross-Practice Insights

// AI in Biotech and Synthetic Biology: What Can Be Protected? What Should Be Kept Secret?

The IP team provides guidance on patenting AI innovations in the life sciences field. Machine learning, bioinformatics, AI, and other computational tools have become ubiquitous, but court guidance in recent years has muddied the waters on what is protectable.

// Managing Multiple Bidders in the Sale of a Company

Advanced planning and adherence to a thorough and organized process should ensure that the seller maximizes the benefits of engaging multiple bidders while controlling the potential pitfalls. Our Transactions team shares their guidance based on successes achieved with clients.

// Are You a Medical Device Servicer or Remanufacturer? FDA’s New Guidance May Help… Or Not

The FDA recently issued its long-awaited “Remanufacturing of Medical Devices Draft Guidance” and solicited industry feedback through August 23. Our FDA team shares their thoughts on the draft guidance and recommendations for modifications to help make the guidance more valuable to the industry.

Industry Activity

// Transactional Activity in the Industry

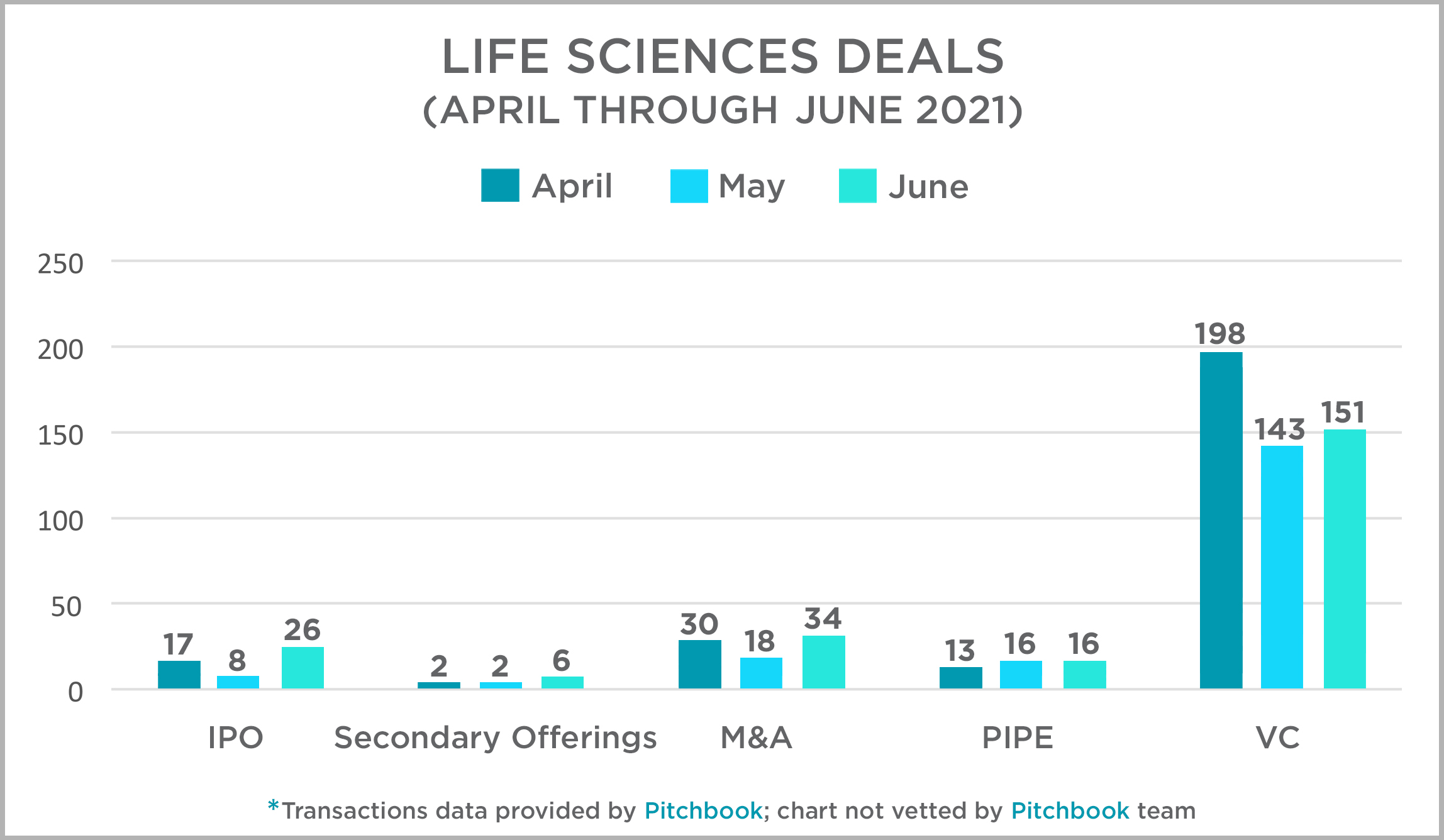

Each quarter, the Mintz Transactions team takes a look at activity across several deal types in the US life sciences sector and presents that data and our thoughts at this link. Overall, transactions in the second quarter were strong, as has been the trend in the industry over the past 12 months. April was a particularly strong month for VC deals, and both IPOs and M&A transactions experienced their best month in May. PIPEs were fairly consistent throughout the quarter. For more information on 2021 deals and to access our 2020 data and assessment, click here or on the title above.

|

// Intellectual Property in the Industry

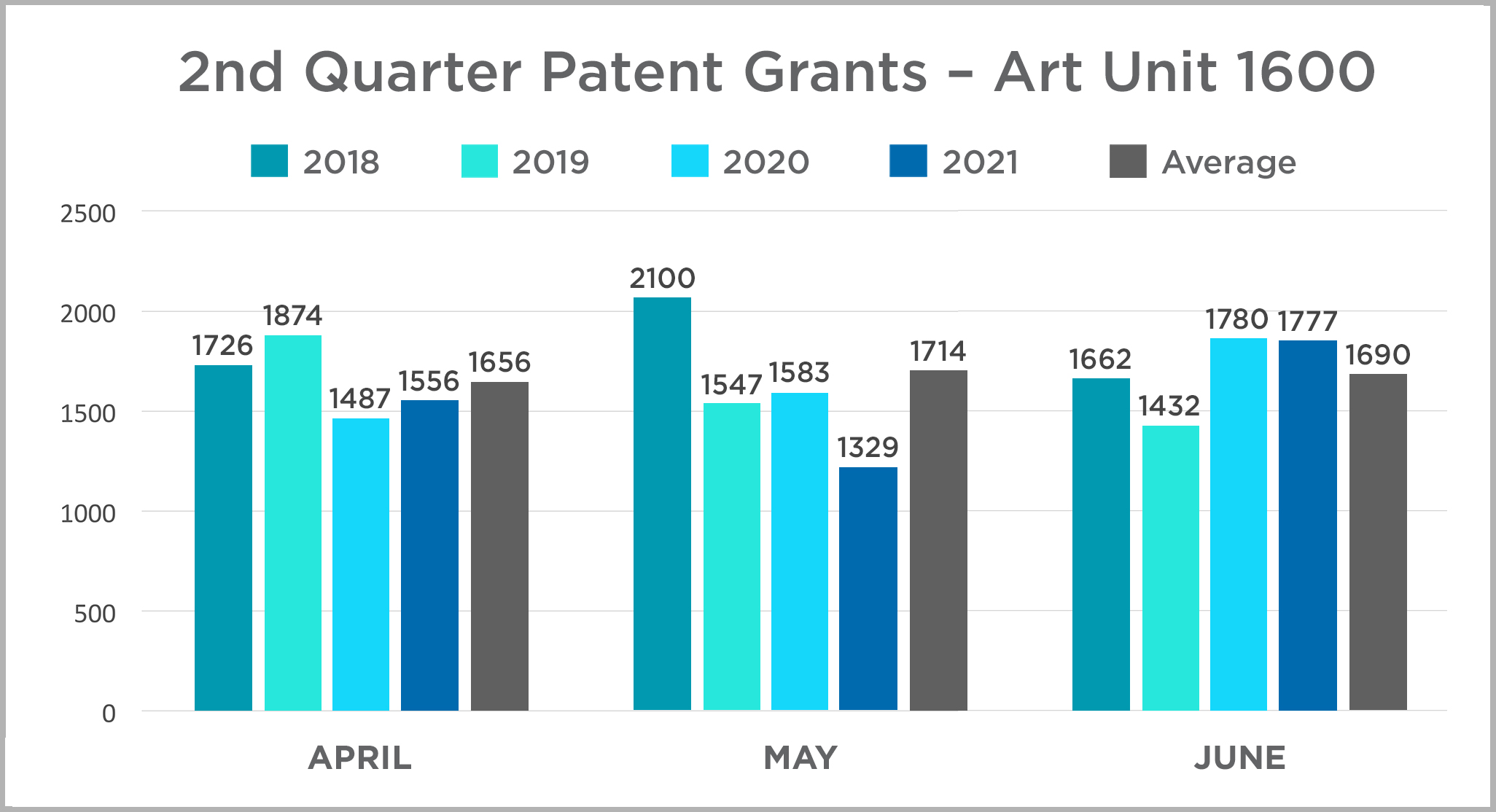

In this edition, we continue the quarterly review of patent grants in the USPTO’s Art Unit 1600. This art unit includes most biological and chemical innovations, and we use it here as an imperfect corollary for patent activity in the life sciences industry. Our review is a year-over-year comparison of patents granted by month each year between 2018 and 2021. The data is presented in charts by quarter for ease of review. Click here or on the title above to view the 2021 data and assessment and to access the 2020 data and assessment.

|

In this edition we also present information about patent pendency in Art Unit 1600. Attached here is a PDF which presents a chart with pendency rates over the past four years in addition to some insights from our team.

Mintz Client Activity

// Quarterly Mintz Life Sciences Transactions

Last quarter, our Life Sciences team handled $4.1+ billion in client transactions, including public offerings, mergers & acquisitions, carveouts, and private financings. We worked on high-end de-SPAC transactions for $1B+ value companies like Quantum-SI and Vicarious Surgical, two carveout transactions for Myriad Genetics, a crossover financing led by Mintz client PFM Health Sciences, and public offerings for clients such as F-star Therapeutics, SELLAS Life Sciences, and Synlogic. Click here to view all 2nd quarter Mintz deals in the Life Sciences sector.

// Favorable First Circuit Decision in Securities Litigation

In June 2021, the First Circuit affirmed a lower court’s judgment confirming Mintz’s complete victory in Karth v. Keryx Biopharmaceuticals. Mintz successfully represented Keryx (and four of its former officers) in a proposed class action alleging securities fraud in federal court and in related state court derivative cases. The plaintiff sought to certify a class consisting of all purchasers of Keryx stock from May 2013 through July 2016, alleging that, during this period, the risk disclosures in Keryx’s SEC filings were inadequate to disclose alleged manufacturing risks, and that when certain manufacturing issues materialized and led to a patient supply interruption on August 1, 2016, Keryx experienced a 63% stock price drop. In 2019, the District Court denied the plaintiff’s motion for class certification, granted the defendants’ motion for judgment on the pleadings, denied as futile the plaintiff’s motion for leave to file a Third Amended Complaint, and entered a final judgment for the defendants on all counts. The plaintiff appealed to the First Circuit Court of Appeals, where Mintz successfully defended the defense judgment. The First Circuit’s opinion was significant because it clarified the standard in the First Circuit for when risk disclosures are not materially misleading as a matter of law.

Mintz Life Sciences Attorneys in the News

Co-chair of the firm’s Life Sciences Practice Bill Whelan was quoted in an article published by Fierce Pharma discussing the findings of Mintz’s latest report produced in partnership with Mergermarket on recent M&A activity in the life sciences. Access the Mintz / Mergermarket report here.

Co-chair of the firm’s Product Liability Practice Joe Blute was quoted in an article published by Law360 that provided analysis on a recent ruling from the US District Court for the District of Massachusetts granting summary judgment to pharmaceutical company GlaxoSmithKline in a lawsuit alleging that its anti-nausea medication Zofran causes birth defects.

In an article published by STAT, transactions attorney Sam Effron was quoted on use among biotechnology and other companies of US Securities and Exchange Commission Rule 506(c), which was designed to allow entrepreneurs to solicit funding more broadly.

IP attorneys Peter Cuomo and Muriel Liberto co-authored an article published in the IP Litigator that examined how the US written description requirement is developing in the ‘unpredictable’ pharmaceutical and biotechnology-related arts.

Co-chair of the firm’s Securities & Capital Markets Practice Megan Gates was quoted in an article published by Law360 examining a sustained increase in at-the-market offerings, a type of registered offering that allows public companies to sell shares in phases so they can seize attractive prices.

Law360 featured the arrival of leading trial lawyer John Dougherty as a Member in our Litigation Practice in Boston. The article highlighted John’s life sciences industry focus and included his commentary on what drew him to Mintz.

// MEET OUR LIFE SCIENCES INDUSTRY TEAM

// LEARN ABOUT THE MINTZ LIFE SCIENCES PRACTICE

// READ MORE LIFE SCIENCES INSIGHTS

|

|

|

|