Mintz IRA Update — The Consequences and Costs of Redesigning the Part D Program

The passage of the Inflation Reduction Act of 2022 (IRA) marked a significant milestone in Congress’s ongoing efforts to address escalating health care costs. While the IRA aims to rein in government spending on Medicare and to lower point-of-sale prescription drug costs for Medicare beneficiaries, its implementation, and adoption of the redesigned Medicare Part D program has sparked a cascade of consequences for Medicare Part D plan sponsors (“PDPs”), beneficiaries, and manufacturers.

Overview of 2025 Part D Redesign

At a high level, the IRA is making the following changes to the standard Part D benefit design and other program elements that will go into effect on January 1, 2025:

- Elimination of the Coverage Gap. The coverage gap will be eliminated in 2025. As a result, the Part D benefit design will consist of three, instead of four, benefit phases: annual deductible, initial coverage, and catastrophic coverage.

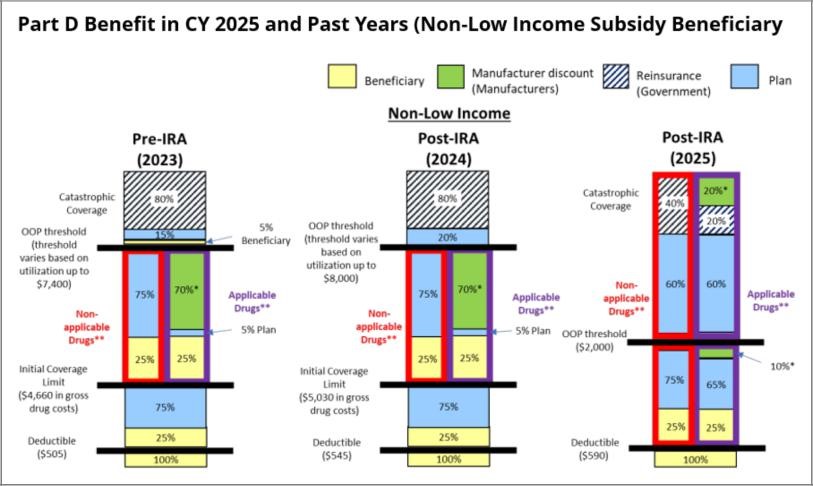

- Changes to Share of Medicare Part D Drug Costs Paid by Beneficiaries, Plans, Drug Manufacturers, and CMS. In 2025, the liability for drug costs paid by a beneficiary, and the costs and risks carried by PDPs, manufacturers, and CMS during each coverage phase will change significantly. Below are the contemplated cost-sharing amounts by benefit phase.

- Annual deductible phase: The beneficiary is responsible for 100% of the cost of drugs during the annual deductible phase.

- Initial coverage phase: The beneficiary will continue to be responsible for 25% of the cost of both Non-Applicable and Applicable Drugs (described below) during the initial coverage phase, which is consistent with prior years. PDPs will be responsible for 65% of the cost of Applicable Drugs, and the remaining 10% of the cost of Applicable Drugs will be covered by the manufacturer’s discount. For Non-Applicable Drugs, the PDP must cover 75% of costs, and the manufacturer does not share responsibility for any costs.

- Catastrophic phase: During the catastrophic phase, PDPs will be responsible for 60% of the cost of both Non-Applicable and Applicable Drugs, an increase from 20% in past years. The government (reinsurance) will cover 40% of the cost of Non-Applicable Drugs and 20% of the cost of Applicable Drugs. The remaining 20% of the cost for Applicable Drugs will be covered by the manufacturer discount.

- Capping Out-Of-Pocket Costs. The beneficiary’s annual out-of-pocket threshold will be capped at $2,000.

- Calculation of TROOP. The IRA updated what costs are counted towards True Out-Of-Pocket Costs (TrOOP), which are used to determine when a beneficiary moves through each coverage phase and reaches the annual out-of-pocket threshold. Beginning in 2025, the IRA makes changes to the definition of “incurred costs,” which is used to calculate TrOOP. Under the amended definition for 2025, the definition of “incurred costs” includes costs incurred for supplemental Part D coverage provided by enhanced alternative (EA) Part D plans and other health insurance (OHI). This includes supplemental coverage provided by EGWPs (a long-standing policy), plan reductions in cost sharing for enrolled beneficiaries, such as reductions by Medicare-Medicaid Plans and D-SNPs, and CMMI model benefits that reimburse costs for covered Part D drugs (unless stated otherwise in a Request for Applications).

- The Medicare Discount Program. Under the Medicare Discount Program (which conceptually replaces the Coverage Gap Discount Program), Part D drugs dispensed to beneficiaries will be subject to manufacturer discounts during both the initial and catastrophic coverage phases of the Part D benefit. Manufacturers are required to offer a 10% discount on Applicable Drugs in the initial coverage phase and a 20% discount on Applicable Drugs in the catastrophic coverage phase. However, a manufacturer is not required to offer a discount under the Medicare Discount Program on a drug that has been selected for the Medicare Drug Price Negotiation program, referred to as “Selected Drugs.” For purposes of the Medicare Discount Program, Selected Drugs are defined to be “Non-Applicable Drugs.”

- Reinsurance. The change in reinsurance for Applicable versus Non-Applicable Drugs has downstream impacts on the reinsurance methodology. Specifically, these changes impact the calculations for annual payments made to PDPs after the reconciliation process that takes into account the PDP-reported direct and indirect remuneration (“DIR”). In CY 2025, CMS will calculate the reinsurance subsidy separately for Applicable and Non-Applicable Drugs and allocate the share of DIR for Applicable and Non-Applicable Drugs based on their respective share of gross drug costs that fall in the catastrophic phase.

In its Fact Sheet on Final CY 2025 Part D Redesign Program Instructions, CMS provided the below visual comparing the 2025 cost sharing to prior years:

|

As displayed in CMS’s comparison, the changes to the Part D benefit design shift liabilities and financial risk towards PDPs. The shifting liability specifically moves risk that was historically carried by beneficiaries, CMS, and drug manufacturers to PDPs. In 2025, PDPs will take on financial risk:

- From beneficiaries, by introducing the $2,000 out-of-pocket threshold for all beneficiaries;

- From manufacturers, who used to fund 70% of drug costs that were incurred during the Coverage Gap for Applicable Drugs (typically brand drugs); and

- From CMS in the catastrophic phase, where CMS historically covered 80% of the cost of the drug but will now only cover 40% of costs for Non-Applicable Drugs (typically generic drugs and Selected Drugs) and 20% of costs for Applicable Drugs.

While these changes may bring relief to many Medicare beneficiaries in terms of capped out-of-pocket costs, it is yet to be determined if these changes will result in increased beneficiaries’ premiums or more restrictive formularies. These changes are also anticipated to have material impacts on PDPs, beneficiaries, and manufacturers.

Impacts on PDPs

On Monday, June 3, 2024, PDPs submitted their bids for contract year 2025. These bids needed to take into account the new benefit design resulting from the IRA. The impact to PDPs was the focus of many comments that CMS responded to as part of its Final Calendar Year Part D Redesign Program Instructions that it released on April 1, 2024 to provide guidance on the implementation of the IRA changes to the Part D program. While the overall changes for PDPs are significant, the true impact of the shifts will be most directly felt by PDPs that enroll a higher-than-average number of beneficiaries who have historically reached the catastrophic coverage phase and are projected to exceed the $2,000 out-of-pocket maximum.

Pressure on Premiums

When CMS released its Draft CY 2025 Part D Redesign Program Instructions, commenters expressed concerns that PDPs would increase premiums due to the number of changes and urged CMS to narrow the risk corridors under Part D for 2025 and beyond. CMS declined this suggestion, noting that it does not have the authority to do so, and stated that the premium stabilization provisions of the IRA would accomplish the same result. The premium stabilization program, which began in 2024 and continues through 2029, limits increases in the Part D base beneficiary premium (BBP) to 6% growth each year.

If PDPs did not have to contend with the IRA limit on premium increases or market competition, PDPs would likely want to increase premiums by a notable amount. PDPs are required to take on more financial risk and, therefore, sell a more comprehensive plan product. Such a change would typically justify a higher premium. PDPs may also want to increase premiums because they might see a sizable loss of rebates, which PDPs cite as a tool to reduce premiums, as manufacturers reduce or eliminate rebates offered on Selected Drugs. PDPs may also see reduced rebates if manufacturers of Applicable Drugs refuse to pay historical rebate amounts as a result of their obligations under the Medicare Discount Program. Further, as discussed more fully below, because PDPs will see a reduced incentive to favor higher-cost drugs as a means to move beneficiaries through coverage phases, PDPs may forego additional rebates.

However, because premium increases are limited by the IRA and high premiums can quickly make a PDP uncompetitive, PDPs may try to dull the impact of the new financial risk by adjusting formularies.

Pressure on Formularies

Some believe that the old benefit structure incentivized PDPs to adopt benefit designs and formularies favoring higher-cost point-of-sale drugs (with higher rebates) because the benefit design could cause beneficiaries to accrue higher-cost shares quickly and reach the Coverage Gap and catastrophic coverage faster. The redesigned Part D benefit provides little reason for PDPs to push beneficiaries beyond the initial coverage phase and potentially incentivizes PDPs to alter their formularies (by putting certain drugs on non-preferred formulary tiers or removing a drug outright) and to employ utilization management tools, like prior authorization or step therapy, to moderate demand growth for certain drugs.

In fact, the drugs that could be most affected by this new incentive structure are those drugs that have yielded the highest total Medicare Part D spending in the past (i.e., Selected Drugs). These Selected Drugs have historically been heavily rebated by manufacturers, contributing to revenue that PDPs use to reduce plan premiums and have been placed in favorable formulary tiers. As a result of the Negotiation Program, PDPs can expect a decrease in manufacturer rebates, which could lead to lower direct & indirect remuneration, higher plan premiums, and lower profits for PDPs. Going forward, the Selected Drugs may be at a disadvantage in PDP formulary designs depending on whether a PDP elects to focus more on rebates and premiums versus lower-cost shares.

While the law requires PDPs to cover the Selected Drugs, there is no requirement that PDPs put those products on a preferred formulary tier, nor are there limits on utilization management tools that PDPs can impose. CMS has acknowledged and expressed its concern that PDPs may be incentivized in certain circumstances to disadvantage Selected Drugs by placing these drugs on less favorable tiers compared to non-Selected Drugs and has promised to continue reviewing clinical formularies to ensure that all PDPs meet applicable formulary requirements.

Impacts on Beneficiaries

- Negative – Premiums: PDPs will likely face financial pressure to increase premiums to account for the new level of coverage, which will impact all beneficiaries.

- Positive/Negative – Formularies:

- PDPs do not have a strong financial incentive to move beneficiaries through benefit phases, and therefore PDPs may favor lower-cost drugs on formularies more than they have historically. This could result in lower point-of-sale cost shares for many beneficiaries.

- Because PDPs are taking on more financial risks, they may apply more utilization management tools than in the past, which can be frustrating to beneficiaries and their providers.

- How PDPs will treat Selected Drugs, which are used by many beneficiaries, remains to be seen. However, beneficiaries may see reduced cost shares as a result of cost shares being calculated off of the Selected Drug’s CMS-negotiated price.

- Positive – Capping Out-of-Pocket Costs at $2,000: This change will materially assist beneficiaries who have historically had high drug costs, who are predicted to be a low percentage of the Medicare population.

- Positive – Changes in True Out-of-Pocket Costs: This change will result in some beneficiaries reaching the out-of-pocket maximum faster than they would have otherwise.

Impacts on Manufacturers

The impact of all of the Part D benefit design changes and potential effects on Selected Drugs will likely produce a wide variety of outcomes for manufacturers. The outcomes will vary because manufacturers and the types of drugs that many manufacturers produce are diverse.

For some brand drug manufacturers, the change from the Coverage Gap Discount Program (70% funded by manufacturers) to the Medicare Discount Program may be a welcome one (10% funded by manufacturers in the initial phase, 20% funded by manufacturers in the catastrophic phase). However, the actual impact of this new program will be different for each manufacturer. A manufacturer with high-cost specialty drugs may have preferred to continue to operate in the Coverage Gap Discount Program because its liability was capped once a beneficiary reached catastrophic coverage.

The introduction of the out-of-pocket maximum to the Part D benefit design could also produce an increase in demand for maintenance drugs that some beneficiaries were not taking as directed in order to reduce costs or were not filling at all.

Further, the overall composition of Part D formularies and potential changes driven by redesigning the Part D benefit could have significant impacts on manufacturers. As discussed above, under Impacts to PDPs, PDPs may elect to prefer drugs with lower list prices as a result of no longer having a strong incentive to move beneficiaries through benefit phases. Manufacturers with such drugs could stand to benefit from increased demand for their products. On the other hand, some PDPs could elect to focus on seeking higher-value rebates on drugs that are alternatives to Selected Drugs so that the PDPs can still collect and benefit from rebates. Such a strategy would advantage such alternative drugs through potential utilization growth, but likely demand rebates at levels that a manufacturer may not have previously offered. Similarly, Selected Drugs could see increased utilization because they will be included on all Part D formularies. However, Selected Drugs that face some level of competition from potential alternative treatments may be confronted with less favorable placement.

In the next few months, as PDP premiums and formularies for 2025 are released, we expect that the impacts of redesigning the Part D program felt by PDPs, beneficiaries, and manufacturers will become much clearer.

Authors

Tara E. Dwyer

Member

Lauren M. Moldawer

Member

David R. Gilboa

Associate

Samantha Hawkins

Associate

Stephnie A. John

Associate