A Quantitative Analysis of Comment Letters Issued by the SEC Concerning Climate Change Disclosures

I. Introduction

Under the Biden administration, the U.S. Securities and Exchange Commission (“SEC”) has advanced a robust agenda concerning climate change issues. This has included several policy proposals, including mandatory climate disclosures and the establishment of the Climate and ESG Task Force within the SEC’s Enforcement Division. Both of these initiatives have been widely reported on by the press and analyzed by relevant legal or industry thought leaders.

Another aspect of the SEC’s regulatory agenda on climate change has been the issuance of comment letters to individual reporting entities focusing on their purported flaws with respect to their climate change disclosures. In September 2021, the SEC published a “Sample Letter to Companies Regarding Climate Change Disclosures” (“Sample Letter”), which stated that “information related to climate-change risks and opportunities may be required in disclosures related to a company’s description of business, legal proceedings, risk factors, and management’s discussion and analysis of financial conditions and results of operations.” The SEC further stated that its “illustrative letter,” provided by the Division of Corporation Finance, “contains sample comments that the Division may issue to companies regarding their climate-related disclosure or the absence of such disclosure,” and outlined nine topics on which the SEC intended to focus. This particular initiative by the SEC has been less frequently the subject of attention following the initial announcement.

This article provides a quantitative analysis of the comment letters issued by the SEC in connection with climate and ESG issues. Relevant comment letters were identified through keyword searches of the EDGAR database (compiling all relevant SEC filings and correspondence) from July 1, 2021 through March 31, 2023. Each letter was examined for responsiveness and coded according to the nine topics identified by the SEC. Following an initial analysis, a separate category of “greenwashing” — e.g., when a reporting entity may be improperly asserting a greater degree of compliance with environmentally friendly principles — was also incorporated into the coding and analysis. The reporting entities that received these letters were also analyzed to discern their key characteristics.

Overall, a relatively limited number of these comment letters were issued by the SEC. Specifically, one hundred and four (104) reporting entities received comment letters echoing the topics in the SEC’s Sample Letter, and a further one hundred and sixty-seven (167) reporting entities received a comment letter relating solely to greenwashing. It should also be noted that an overwhelming majority (86%) of the reporting entities receiving a letter solely concerning greenwashing were “Investment Entities” — funds, trusts, or other vehicles solely focused on investing in other companies or assets, rather than traditional companies. And, while the SEC has continued to focus on the issue of greenwashing, most of the SEC comment letters concerning the climate change topics identified in the Sample Letter were issued either in September 2021 (when the Sample Letter was published) or in a second burst of activity from May–September 2022 — the SEC does not appear to have inquired about those topics since November 2022. Finally, it is also noteworthy that the reporting entities receiving a comment letter aligned with the topics identified in the Sample Letter were concentrated in the Energy & Transport or Manufacturing sectors — about two-thirds of the total.

The following sections provide a more detailed analysis of the comment letters issued by the SEC in connection with the climate change disclosures identified by the SEC’s Sample Letter and the key characteristics of the reporting entities that received said letters.

II. General Findings

We performed a series of targeted searches to identify relevant SEC comment letters.[1] Our survey identified 448 comment letters sent by the SEC between July 1, 2021 and March 31, 2023 that corresponded to either the nine topics identified in the Sample Letter or the separate issue of greenwashing. These letters were received by a total of 271 reporting entities. (Many reporting entities received one or more follow-up letters concerning the same issues.) Of these entities, 104 had received a letter concerning at least one of the nine questions (or a variation thereof) identified in the Sample Letter. A further 167 reporting entities received a letter that posed questions or demonstrated an interest solely in the phenomenon of “greenwashing,” e.g., manipulating figures or marketing materials to indicate that a reporting entity was (unjustifiably) more environmentally friendly.

The reporting entities that received SEC comment letters were either “Companies” or “Investment Entities.” For purposes of this analysis, we considered Investment Entities to constitute reporting entities that were funds, trusts, or vehicles solely focused on investing in other companies or assets, that report pursuant to the Investment Company Act of 1940, were identified as such by the Intelligize database, or both. Companies constituted all other reporting entities. The overwhelming majority of reporting entities that received comment letters corresponding to the Sample Letter were Companies — fully 95.2% of the total (99 out of 104 reporting entities). Conversely, the vast majority of reporting entities that received comment letters solely focused on greenwashing were Investment Entities — 85.6% of the total (143 out of 167 reporting entities).

The following sections discuss in greater detail the relevant characteristics of the SEC comment letters and the reporting entities that received them, focusing on (1) the questions asked by the comment letters, (2) the timing of the comment letters, and (3) the market capitalization and industry of the reporting entities that received the SEC comment letters. The majority of this analysis focuses on the 104 reporting entities that received SEC comment letters corresponding to the Sample Letter.

III. SEC Climate Change Comments

The SEC’s Sample Letter provided nine separate questions concerning different aspects of a company’s climate disclosures. These questions could be categorized as corresponding to the following topics: (1) a CSR Report; (2) Transition Risk; (3) Litigation Risk; (4) Legislation & Regulation; (5) Capital Expenditures; (6) Indirect Consequences; (7) Physical Effects; (8) Compliance Costs; and (9) Carbon Offsets. As discussed above, the topic of greenwashing was not identified specifically in the Sample Letter. For the sake of clarity, the below table replicates each of the questions posed by the Sample Letter in the order established by the Sample Letter.

Category of Question | Question |

CSR Report | We note that you provided more expansive disclosure in your corporate social responsibility report (CSR report) than you provided in your SEC filings. Please advise us what consideration you gave to providing the same type of climate-related disclosure in your SEC filings as you provided in your CSR report. |

Transition Risk | Disclose the material effects of transition risks related to climate change that may affect your business, financial condition, and results of operations, such as policy and regulatory changes that could impose operational and compliance burdens, market trends that may alter business opportunities, credit risks, or technological changes. |

Litigation Risk | Disclose any material litigation risks related to climate change and explain the potential impact to the company. |

Legislation & Regulation | There have been significant developments in federal and state legislation and regulation and international accords regarding climate change that you have not discussed in your filing. Please revise your disclosure to identify material pending or existing climate change-related legislation, regulations, and international accords and describe any material effect on your business, financial condition, and results of operations. |

Capital Expenditures | Revise your disclosure to identify any material past and/or future capital expenditures for climate-related projects. If material, please quantify these expenditures. |

Indirect Consequences | To the extent material, discuss the indirect consequences of climate-related regulation or business trends, such as the following: - Decreased demand for goods or services that produce significant greenhouse gas emissions or are related to carbon-based energy sources; - Increased demand for goods that result in lower emissions than competing products; - Increased competition to develop innovative new products that result in lower emissions; - Increased demand for generation and transmission of energy from alternative energy sources; and - Any anticipated reputational risks resulting from operations or products that produce material greenhouse gas emissions. |

Physical Effects | If material, discuss the physical effects of climate change on your operations and results. The disclosure may include the following: - Severity of weather, such as floods, hurricanes, sea levels, arability of farmland, extreme fires, and water availability and quality; - Quantification of material weather-related damages to your property or operations; - Potential for indirect weather-related impacts that have affected or may affect your major customers or suppliers; - Decreased agricultural production capacity in areas affected by drought or other weather-related changes; and - Any weather-related impacts on the cost or availability of insurance. |

Compliance Costs | Quantify any material increased compliance costs related to climate change. |

Carbon Offsets | If material, provide disclosure about your purchase or sale of carbon credits or offsets and any material effects on your business, financial condition, and results of operations. |

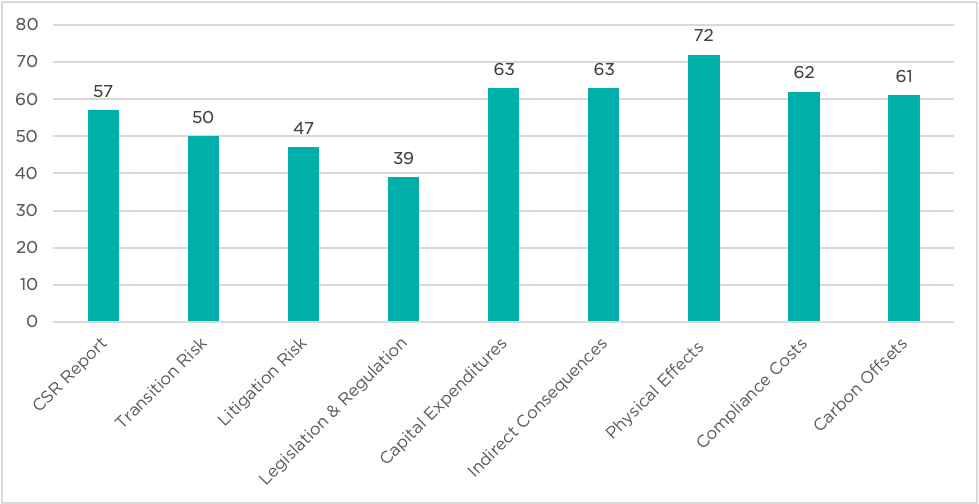

As can be seen, the SEC’s Sample Letter poses questions on a wide variety of topics relating to climate change, many of which are not necessarily correlated with one another. Reflecting that circumstance, the frequency that each of these categories of questions appeared in the actual comment letters issued by the SEC differed dramatically, as revealed by the following bar chart. (This chart omits greenwashing, as this was not a category identified in the Sample Letter.)

Chart #1: Number of Comments Received by Category of Comment

The most frequent type of question posed by the SEC concerned the Physical Effects of climate change (72), while the least frequent type of question posed by the SEC concerned the impact of Legislation & Regulation (39) — indeed, nearly twice as many reporting entities received a question concerning Physical Effects rather than Legislation & Regulation. That said, of the nine categories of questions, no fewer than four categories — Capital Expenditures (63), Indirect Consequences (63), Compliance Costs (62), and Carbon Offsets (61) — appeared in almost exactly the same number of letters, and questions about a CSR Report (57) were also similar in number. Likewise, questions concerning Transition Risk (50) and Litigation Risk (47) occurred at a similar frequency to one another.

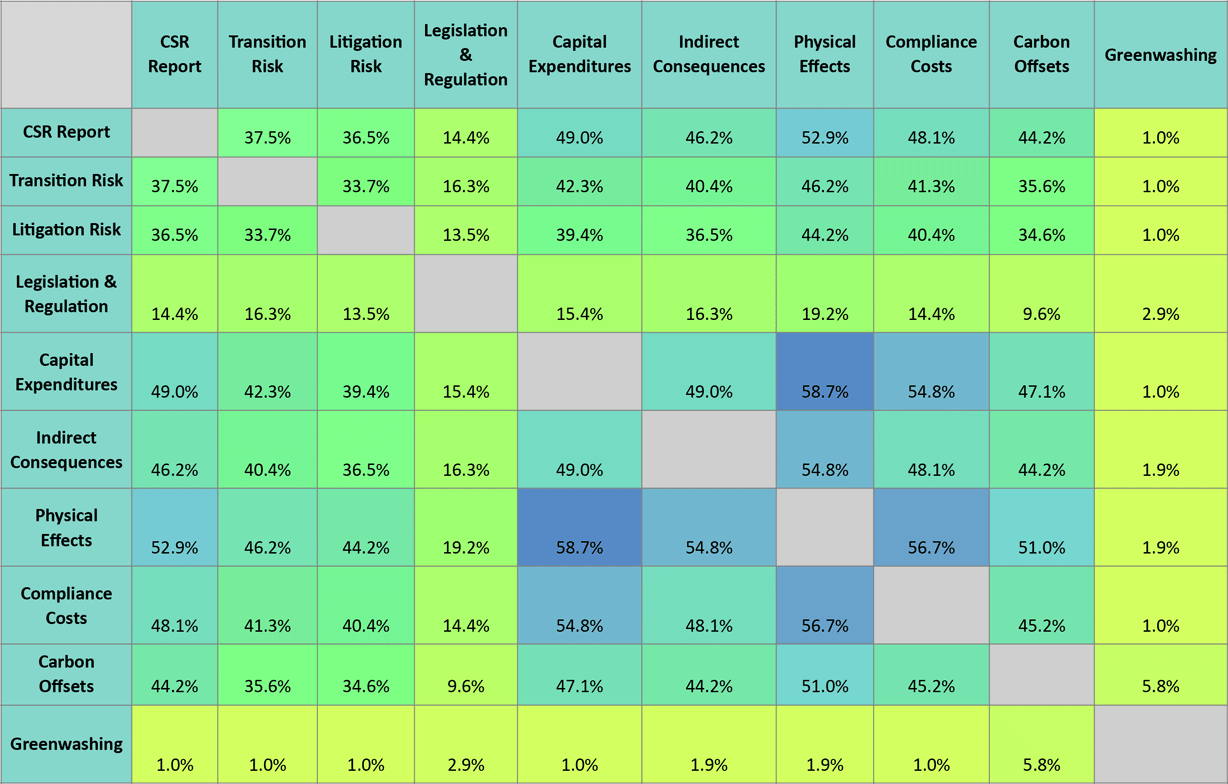

Part of the reason for this discrepancy in the frequency with which the SEC posed questions on particular topics is that the SEC tended to ask certain types of questions in tandem. The below table indicates the percentage of instances in which an individual correspondence featured the same categories of comments. For example, 37.5% of the 104 letters corresponding with the Sample Letter featured comments concerning both the CSR Report and Transition Risk. The shading in the table indicates the relative degree of overlap. (This table excludes the letters that featured greenwashing-only comments.)

Chart #2: Degree of Concordance Between Categories of Comments

Indeed, the above chart — although appropriately displaying the relative degree of overlap between categories of comments — could even be understood to understate the case. The figures in the chart indicate the share of total reporting entities (excluding those who only received greenwashing comments) that received letters containing any two categories of comments. For example, as can be seen above, comments concerning Litigation Risk were often coupled with questions about the Physical Effects of climate change — 44% of reporting entities (46 of 104) received a letter containing both questions. But when considering only those reporting entities that received comments about Litigation Risk, fully 98% (46 of 47) also received a question about Physical Effects. Similarly, reporting entities that received comments concerning Capital Expenditures (97% — 61 of 63), a CSR Report (96% — 55 of 57), Transition Risk (96% — 48 of 50), Compliance Costs (95% — 59 of 62), and Indirect Consequences (90% — 57 of 63) also received a comment concerning the Physical Effects of climate change in 90% or more of the correspondence. Likewise, comments concerning Capital Expenditures were often (and unsurprisingly) paired with Compliance Costs — 90% (57 of 63) of the reporting entities that received a comment concerning Capital Expenditures also received a comment about Compliance Costs. Conversely, questions concerning Legislation & Regulation often appeared in the absence of other questions about climate disclosures — of the twenty reporting entities that only received a single comment concerning climate disclosures, fifteen (75%) received a question about Legislation & Regulation.

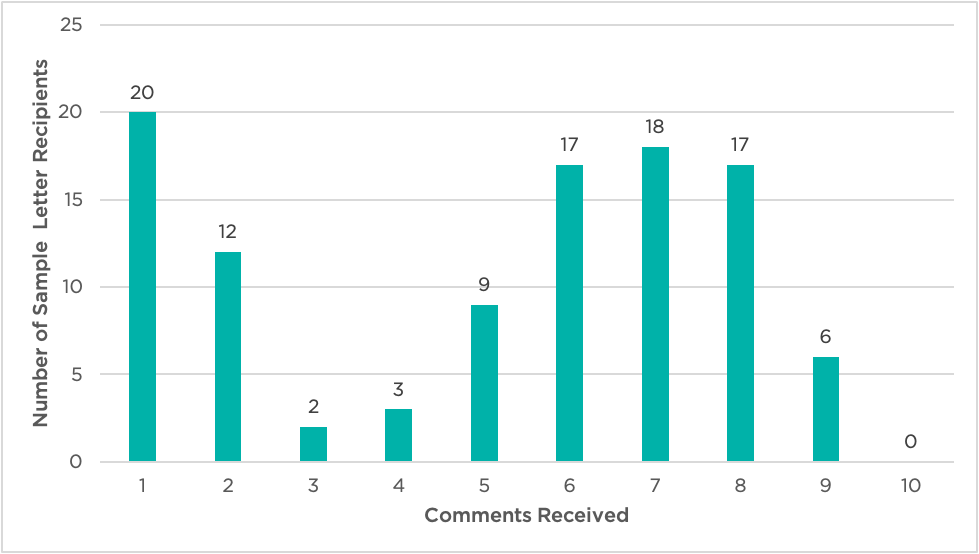

The majority of the comment letters issued by the SEC contained multiple comments related to climate change disclosures. The following bar chart displays the number of categories of comments for which individual reporting entities received questions. (This chart includes comments concerning greenwashing in addition to the topics identified by the SEC, so there are ten categories considered. However, the 167 reporting entities that only received comments concerning greenwashing were excluded from this analysis.)

Chart #3: Sample Letter Recipients by Number of Comments Received

As can be seen, exactly half of all comment recipients (52) received questions concerning between six and eight categories concerning climate change disclosures. But the most frequent number of categories for which the SEC posed a question was merely a single category — twenty (20) reporting entities, or 19%. (And fully ten (10) of the twelve (12) reporting entities for which two climate disclosure questions were received included a question concerning greenwashing, which further emphasizes that a significant fraction — about 29% of reporting entities — only received a single question corresponding to the topics in the Sample Letter.) In effect, a company was likely to receive a letter that either asked about most of the categories identified in the Sample Letter (58 reporting entities, or 56%, received questions about six or more categories), or only a single question (30 reporting entities, or 29%, received only a single question about the categories in the Sample Letter). Those that were asked about a handful of categories (2–3) represented a relatively small percentage (16%).

It should also be noted that a substantial number of reporting entities received comments focused only on the topic of greenwashing — 167 reporting entities, or more than all of the 104 reporting entities that received questions concerning the topics identified in the Sample Letter. And greenwashing was infrequently considered among the letters corresponding to the Sample Letter — only eleven (11) reporting entities received questions concerning both greenwashing and the topics identified in the Sample Letter. So, fully 94% of reporting entities that received questions concerning greenwashing only received questions about greenwashing. And 89% of the recipients of SEC letters corresponding to topics identified in the Sample Letter were not questioned about greenwashing. (A partial explanation for this may be due to the fact that the vast majority of reporting entities that received questions about greenwashing were Investment Entities, and such questions often related to possibly improper names assigned to various funds in violation of the SEC’s proposed Names Rule.[2])

Overall, it appears that the reporting entities that received questions corresponding to the topics identified in the Sample Letter were usually asked about a majority of those topics, and that Physical Effects, Capital Expenditures, Indirect Consequences, Compliance Costs, and Carbon Offsets were the most frequent climate change topics that were the subject of inquiry.

IV. Timing of Letters Sent by SEC

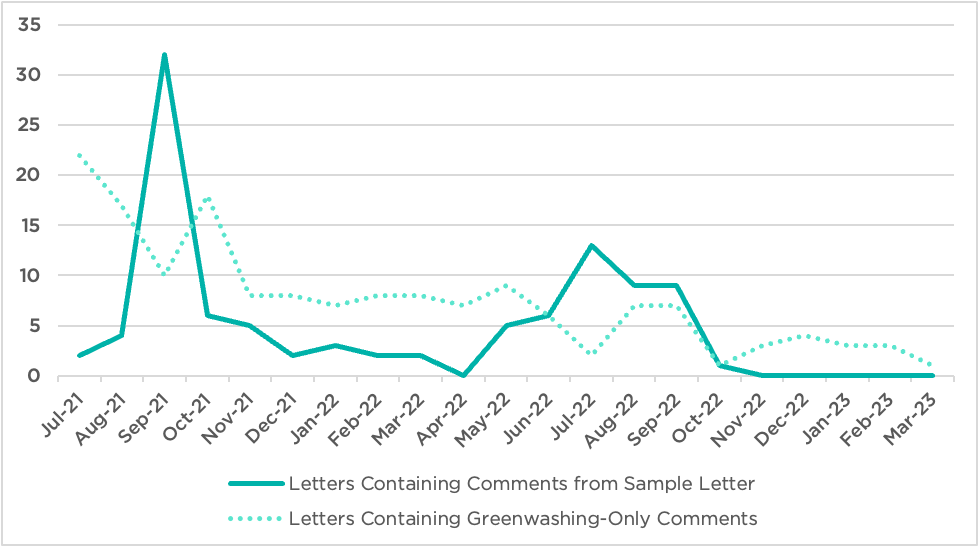

Unsurprisingly, a significant portion of these comment letters were sent by the SEC shortly before or directly after the staff of the SEC’s Division of Corporate Finance published the Sample Letter concerning climate disclosures on September 22, 2021. (For purposes of this study on timing, only the initial comment letters sent by the SEC to each reporting entity were considered.) The following chart illustrates when each initial SEC correspondence was sent to these reporting entities, both for those receiving comments corresponding to the Sample Letter and those only receiving comments related to greenwashing.

Chart #4: SEC Initial Correspondence Comment Letters from July 2021 to March 2023[3]

As the graph above indicates, there was an initial surge in SEC comment letters corresponding to the Sample Letter in September of 2021, when the SEC’s Division of Corporate Finance published the Sample Letter. This month ultimately constituted the overall peak in this type of inquiry — indeed, nearly a third of all letters (thirty-two letters) focusing on the categories articulated in the SEC Sample Letter were sent in the single month of September 2021. The SEC renewed its focus on this area from about May to September 2022, in which forty-two letters were sent over the course of these five months, reflecting another sustained burst of activity in this area — about 40% of the total number of letters. Subsequent to October 2022, when only one letter was sent, the SEC has not sent a single letter asking about the categories of questions propounded in the September 2021 Sample Letter.

As noted above, the SEC sent initial correspondence consisting of comment letters relating solely to greenwashing to one hundred and sixty-seven (167) reporting entities. The apparent zenith of this campaign (within the time period in question) occurred in July 2021, when the SEC sent twenty-two reporting entities comment letters that solely concerned greenwashing. Overall, about sixty-seven of these letters (42%) were delivered between July and October 2021. Unlike the letters containing comments corresponding to the Sample Letter, the SEC continued to send letters with greenwashing-only comments through the end of the review period, albeit at a slower rate. Between December 2021 and September 2022, the SEC sent seven comment letters per month on average that featured greenwashing-only comments. That rate dropped to three letters per month on average between October 2022 and March 2023.

V. Entities Targeted by the SEC

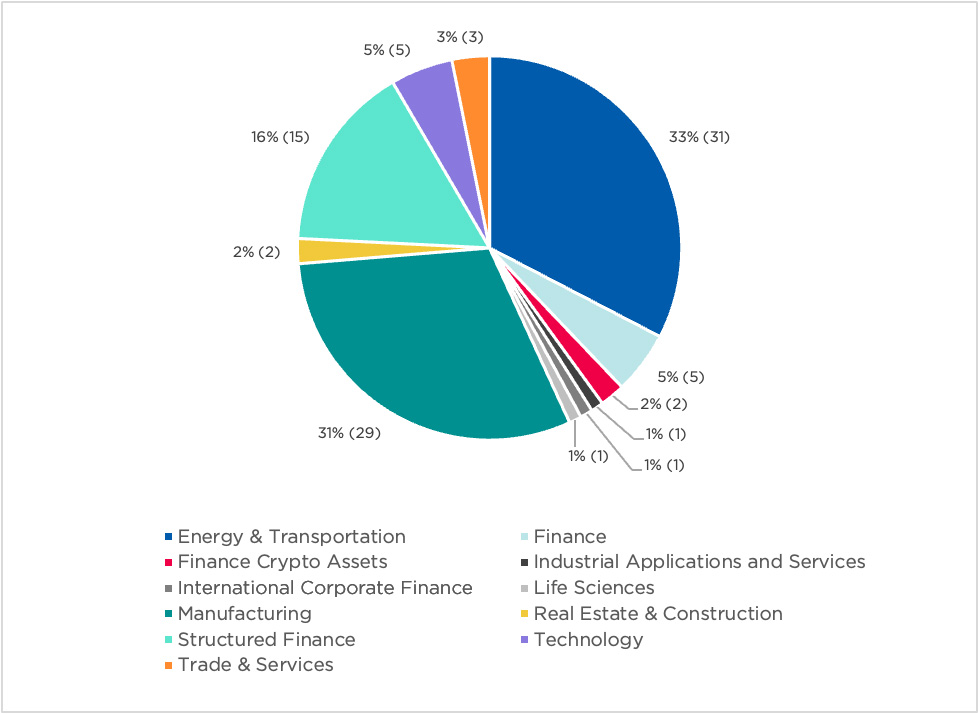

We also captured information on the industries and types of businesses that were targeted by the SEC in its comment letter campaign. Based on SEC Office and Standard Industrial Classification (SIC) codes,[4] we analyzed which industries the recipients of the SEC comment letters were associated with. Unsurprisingly, the SEC appears to have targeted reporting entities in the Energy and Transportation (31 reporting entities or 33%) and Manufacturing (29 reporting entities or 31%) industries. The majority of the remaining company recipients of SEC comment letters corresponding to the Sample Letter were scattered across a variety of industries, including the Structured Finance, Finance, and Technology industries.

Suffice it to say, the industries that were highly targeted by the SEC appear to have a greater connection to climate change. Targeted industries either produce large amounts of greenhouse gas emissions or are susceptible to climate-related transition risks brought on by rapid technological change or changes in consumer sentiment related to concerns regarding climate change. For example, one group of comment letter recipients were the automobile finance companies associated with car manufacturers — seven (7) of these automobile finance companies received such letters. It is unsurprising that such reporting entities — which are heavily associated with greenhouse gas emissions, and thus climate risk — are frequently the target of SEC comment letters concerning climate change disclosures.

Chart #5: Industry of Sample Letter Recipients[5]

Letter recipients within the two most targeted industries (Energy & Transport and Manufacturing) also tended to be concentrated among specific sub-industries. For example, 30% of recipients operating in the Energy & Transport industry were engaged in the Crude Petroleum & Natural Gas sub-industry, while 16% were involved in Electrical Services or energy production. Again, these industries are likely some of the most affected by the changing environment, as well as evolving consumer sentiment concerning fossil fuel production. Among the reporting entities in the Manufacturing industry category, around 20% were involved in automobile manufacture. Otherwise, the letters were scattered relatively evenly across a wide variety of subcategories.

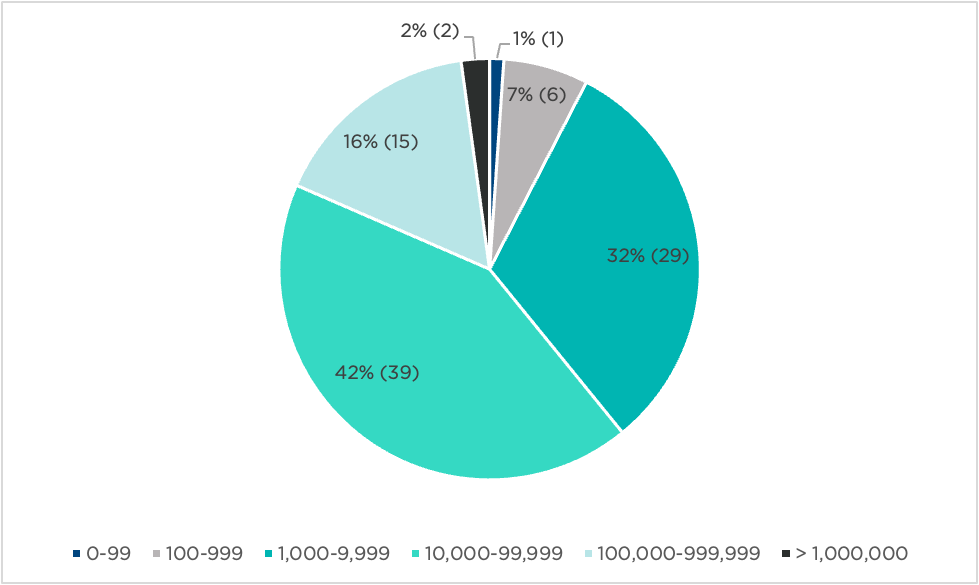

We also reviewed the size of reporting entities receiving letters corresponding to the Sample Letter in terms of market capitalization. The largest segment of recipients (42% or 39 reporting entities) had a market capitalization of between $10 and $99 billion at the time of the initial correspondence from the SEC. A sizeable segment (32% or 29 reporting entities) had market capitalizations of between $1 billion and $10 billion. Only 8% or 7 entities had a market capitalization of under $1 billion. The largest sample letter recipients surveyed, those boasting market capitalizations of over $100 billion, accounted for 18% or 17 reporting entities.

Chart #6: Market Capitalization of Sample Letter Recipients ($ MM)[6]

VI. Conclusion

The comment letters issued by the SEC concerning alleged flaws in climate disclosures are just one aspect of the SEC’s multipronged agenda with respect to climate change issues. And, ultimately, this particular regulatory initiative was relatively limited in scope (though not with respect to greenwashing). Only slightly more than one hundred reporting entities received these comment letters, which were heavily concentrated in industries most likely to be significantly impacted by climate change — i.e., Energy & Transport and Manufacturing — and the SEC does not appear to have issued any new comment letters with respect to these issues since November 2022 (although it is certainly possible that additional comment letters will be published in connection with this year’s financial reporting).

But this analysis also revealed a consistent focus on issues pertaining to greenwashing — and the SEC’s inquiries into greenwashing, while concentrated on Investment Entities, were also spread among a number of Companies in a wide variety of industries. This focus by the SEC, despite the recent decline in the number of letters, may well persist.

It is also possible that the SEC has de-emphasized this type of comment letter in the expectation that the more robust set of mandatory climate disclosures will soon be officially promulgated. If so, it can reasonably be anticipated that the SEC will continue to issue comment letters focused on climate issues — however, these comment letters will be more closely aligned with the SEC’s mandatory climate disclosures than the Sample Letter.

Endnotes

[1] The review team used targeted climate change–related keywords to search EDGAR’s database (via EDGAR’s Advanced Text Search) for all letters sent by the SEC, within the date range of 2021-07-01 through 2023-03-31, containing questions that correspond to those listed in the SEC’s Sample Letter to Companies Regarding Climate Change Disclosures (the “SEC’s Sample Letter”). The team then recorded the types of comments received in each letter, the names of company recipients, the total number of comment letters received by each recipient, and other company-specific data for each recipient. This information is saved in a database, along with the letters themselves, which is available upon request. Our analysis in this article flows from our findings recorded in said database.

[2] On May 25, 2022, the Securities and Exchange Commission proposed an amendment to Rule 35d-1 under the Investment Company Act of 1940 (the Names Rule). The proposed amendment would require “certain funds to adopt a policy to invest at least 80 percent of their assets in accordance with the investment focus the fund’s name suggests; [p]rovid[e] new enhanced disclosure and reporting requirements; and [u]pdate the rule’s current notice requirements and establish[] recordkeeping requirements.”

[3] We note that 8 of 271 (3%) of the letters reviewed — including both comment letters corresponding to the Sample Letter (2) and those that merely included greenwashing-only comments (6) — did not identify when the SEC sent the letter and were thus excluded from the graph.

[4] SEC Office codes describe the sector of the economy in which a company operates. SIC Industry Codes are included in a company’s EDGAR filings and indicate the company’s type of business.

[5] We used Intelligize to determine the proper SEC industry for each recipient of a letter corresponding to the Sample Letter. We note that this information was unavailable for the five Investment Entities that received a comment letter corresponding to the Sample Letter. These were excluded from this analysis.

[6] We used several online sources, including Macrotrends.com, JSEInvestor.com, and Ycharts.com, to determine the market capitalization of each recipient of a letter corresponding to the Sample Letter at the time said entity received the initial correspondence from the SEC. We note that we were unable to determine the market capitalization for twelve (12) of 104 recipients, or 12% of those companies surveyed at the time of the initial correspondence from the SEC.

Authors

Jacob H. Hupart

Member

Douglas P. Baumstein

Member / Co-chair, Securities Litigation Practice

Thomas R. Burton, III

Member / Chair, Sustainable Energy & Infrastructure Practice

John Condon

Will G. McKitterick

Associate

Jaidyn M. Jackson