A Quantitative Analysis of Comment Letters Issued by the SEC Concerning Climate Change Disclosures: Further Developments

I. Introduction

In June 2023, Mintz published an article entitled “A Quantitative Analysis of Comment Letters Issued by the SEC Concerning Climate Change Disclosures” (the June 2023 Article), which analyzed the comment letters related to climate change issued by the US Securities and Exchange Commission (SEC) to individual reporting entities, between July 1, 2021 and March 31, 2023. That article sought to explore the practical impact of the SEC’s September 2021 “Sample Letter to Companies Regarding Climate Change Disclosures” (Sample Letter), which identified nine (9) climate-related topics on which the SEC planned to focus, and to provide analysis and insight into the various climate-related comments issued by the SEC and the targets of that regulatory focus.

This article provides an updated quantitative analysis of the further comment letters issued by the SEC in relation to climate change and environmental, social, and governance (ESG) principles for the period between April 1, 2023 and December 31, 2024 — effectively, until the conclusion of the Biden administration. The identical methodology was employed — namely, identifying relevant comment letters through keyword searches of the EDGAR database (compiling all relevant SEC filings and correspondence) from April 1, 2023 through December 31, 2024. Additional analysis was then performed on the contents, nature, and timing of those letters, as well as on the reporting entities that received such letters.

Generally speaking, far fewer relevant comment letters were issued by the SEC in the past 21 months (April 1, 2023 through December 31, 2024) than in the prior 21-month period (July 1, 2021 through March 31, 2023) that was the subject of our initial analysis. Our research identified only one hundred and nineteen (119) relevant comment letters issued between April 1, 2023, and December 31, 2024, as compared to two hundred seventy-one (271) relevant comment letters issued during an identical 21-month period of July 1, 2021 through March 31, 2023. So, there was a substantial decrease in the overall rate of climate-related comment letters issued by the SEC — while approximately 12.9 letters per month were issued from July 1, 2021 through March 31, 2023, only around 5.7 letters per month were issued during the most recent 21-month period (April 1, 2023 through December 31, 2024) — a decline of over fifty percent (50%).

Additionally, of the one hundred nineteen (119) comment letters identified for the more recent period, only forty-eight (48) included at least one comment from the SEC’s Sample Letter, while a further seventy-one (71) reporting entities received a comment letter relating solely to greenwashing — i.e., when a reporting entity may be improperly asserting a greater degree of compliance with environmentally friendly principles. Notably, and similar to the data in the June 2023 Article, a vast majority of the reporting entities (93%) receiving a letter that solely concerned greenwashing were “Investment Entities” — funds, trusts, or other vehicles solely focused on investing in other companies or assets, rather than traditional operating companies. Additionally, it is noteworthy that of the nine (9) sample comments contained within the Sample Letter, only five (5) were asked with relative frequency. The other four (4) comments barely featured — one was asked four (4) times, another twice (2), and two (2) were not asked at all during the relevant period.

So, even during the second half of the Biden administration, the issuance of comment letters concerning the topics in the Sample Letter and greenwashing had already diminished significantly (~40%), and nearly half (~44%) of the topics originally identified had been effectively abandoned by the SEC. Thus, the Trump administration’s anticipated shift from policies and efforts related to combatting climate change would only accelerate a pre-existing trend.

The following sections offer a detailed analysis of the identified comment letters and key takeaways from this analysis.

II. SEC Climate Change Comments

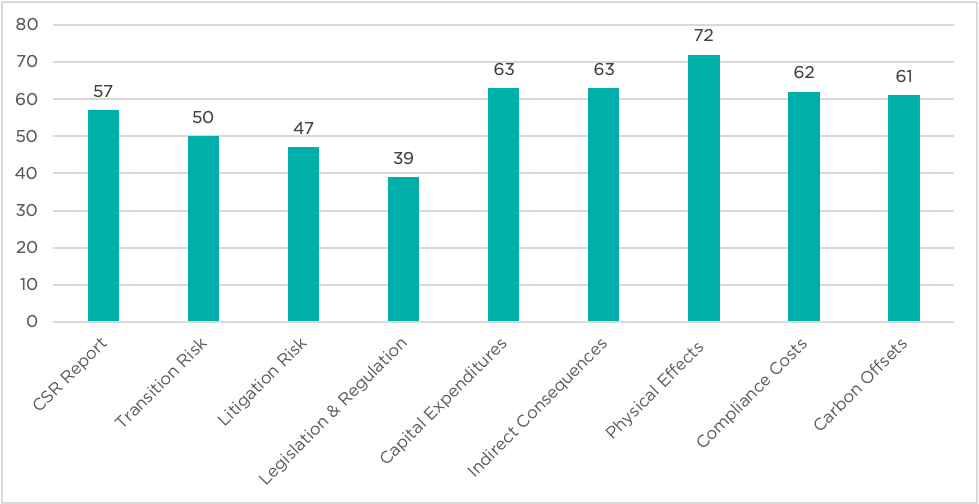

Initially, the SEC pursued all of the nine (9) categories of comments included in the Sample Letter, as demonstrated by the below chart.

Chart #1: Number of Comments Received by Category of Comment (July 1, 2021 – March 31, 2023)

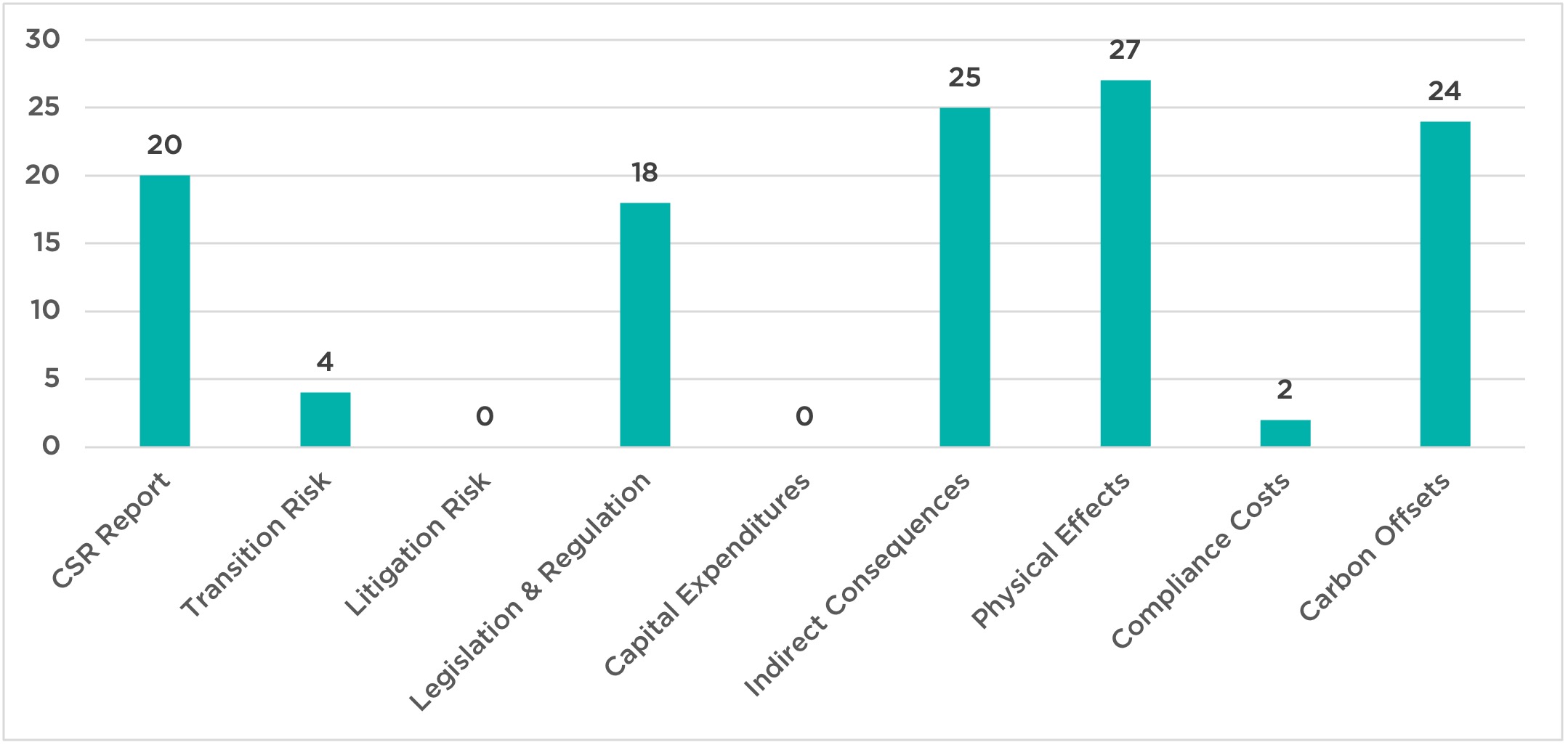

However, as the below graph (Chart #2) indicates, the SEC has now essentially determined to exclude certain sample comments from the comment letters it issues.[1]

Chart #2: Number of Comments Received by Category of Comment (April 1, 2023 – December 31, 2024)

As can be seen above, during the later review period, the SEC has effectively abandoned issuing comment letters pertaining to four (4) of the nine (9) categories of sample comments. Specifically, between April 1, 2023 and December 31, 2024, the SEC only asked four (4) questions related to Transition Risk and two (2) concerning Compliance Costs — this is a steep decline from the fifty (50) Transition Risk and sixty-two (62) Compliance Costs questions posed in the earlier period. Most significantly, the SEC did not ask a single question concerning either Litigation Risk or Capital Expenditures, both of which had been featured frequently (forty-seven (47) and sixty-three (63) questions, respectively) during the July 1, 2021 to March 31, 2023 period.

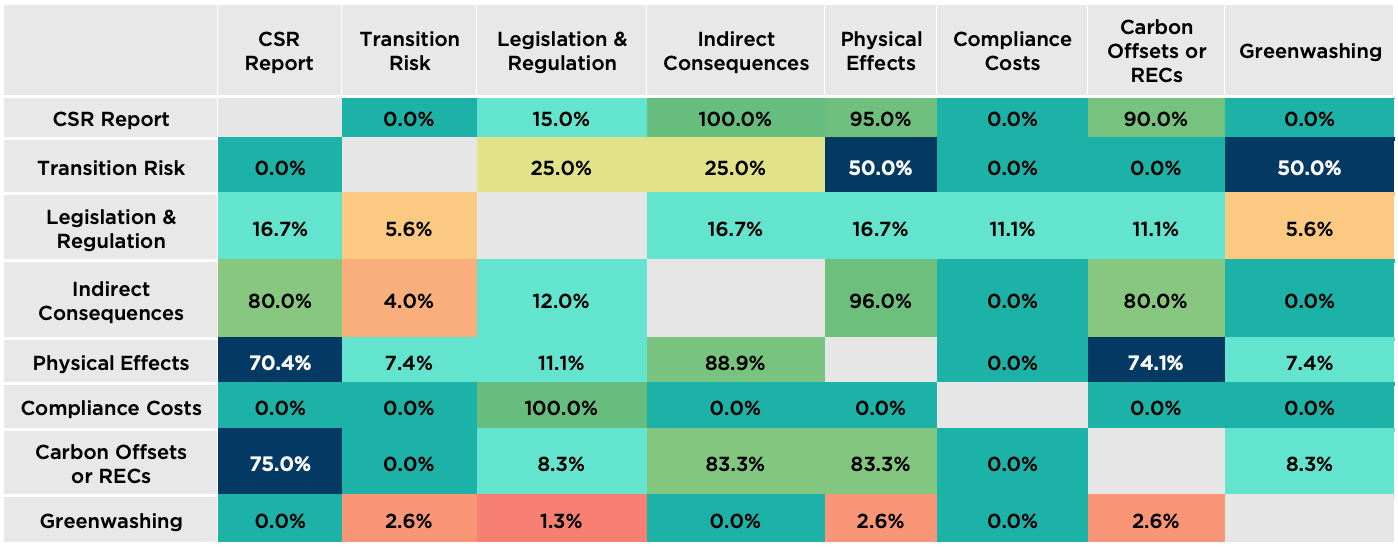

Notably, one trend revealed by the data is that when the SEC does issue comment letters, they tend to offer several comments within each comment letter. The comment letters identified in our review that contained questions relating to the categories in the Sample Letter often included a mix of comments in the following categories: (i) CSR Report (20), (ii) Legislation & Regulation (18), (iii) Indirect Consequences (25), (iv) Physical Effects (27) and (v) Carbon Offsets (24). These categories all appeared with relatively equal frequency during this time period, with each comment issued between eighteen (18) and twenty-seven (27) times. Further, certain categories often appeared in combination with one another, as demonstrated by the below table, which illustrates the percentage of instances in which an individual correspondence featured the same categories of comments. The shading in the table indicates the relative degree of overlap. (This table excludes the letters that featured greenwashing-only comments.)

Chart #3: Degree of Concordance Between Categories of Comments

This chart demonstrates the high degree of concordance between certain categories of comments — for example, four of the categories of comments (CSR Reports, Indirect Consequences, Physical Effects, and Carbon Offsets) are often featured together. (One potential explanation is that Indirect Consequences, Physical Effects, and Carbon Offsets are often factors featured in CSR Reports, which could explicate why an inquiry by the SEC would involve all of these subjects.) In contrast, the category of Legislation & Regulation was infrequently asked in conjunction with the aforementioned four (4) topics — yet each of the two questions asked by the SEC relating to Compliance Costs was featured in tandem with the category of Legislation & Regulation.

Of note, the overwhelming majority of reporting entities that received comment letters corresponding to the Sample Letter (without greenwashing) were classified as “Companies” (forty-five (45) out of forty-eight (48), or 93.75%), as opposed to Investment Entities.[2] This trend suggests that the SEC’s recent enforcement priorities concerned Companies with respect to the issues identified in the Comment Letter while focusing greenwashing efforts on Investment Entities.

III. Greenwashing-Only Letters

The proportion of greenwashing-only letters remained roughly the same as in the prior period covered in the June 2023 Article. During the time period from July 1, 2021 through March 31, 2023 analyzed in the June 2023 Article, one-hundred sixty-seven (167) out of two hundred seventy-one (271), or 61.6%, of the comment letters included only comments related to greenwashing; similarly, in the time period analyzed here — April 1, 2023 through December 31, 2024 — fully seventy-one (71) out of one hundred nineteen (119), or 59.6%, of the comment letters included only comments related to greenwashing. This percentage is nearly identical.

Further, as an additional parallel to the June 2023 Article, the vast majority — 93% — of reporting entities that received greenwashing-only comment letters here were Investment Entities (66 out of 71). This is similar to the findings in the June 2023 Article, where 86% of all reporting entities receiving greenwashing-only letters were Investment Entities.

So, the SEC appears to maintain a steady interest in reviewing company filings with an eye on information indicative of greenwashing, which has primarily impacted Investment Entities. However, as noted previously, we expect this focus will shift under the Trump administration.

IV. Timing of Letters Sent by SEC

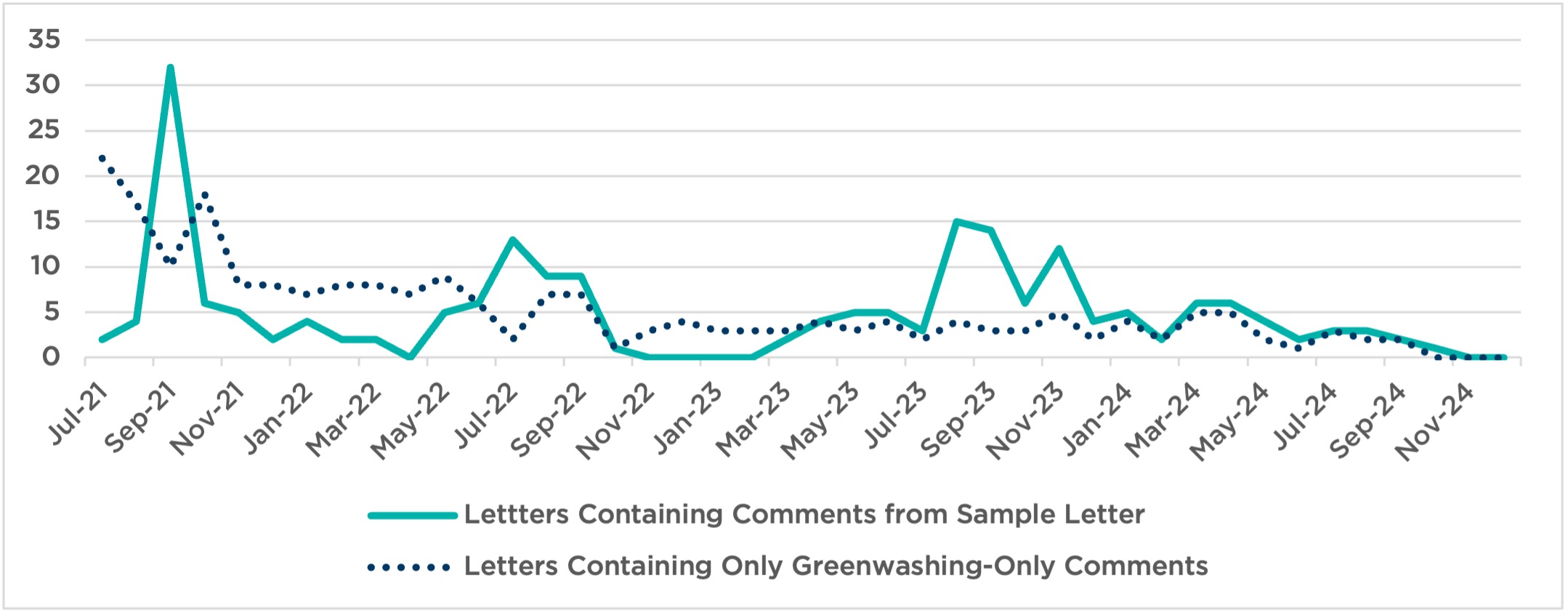

The below chart depicts when relevant SEC comment letters were issued to reporting entities, and includes the relevant data from the June 2023 Article, as well as the data from the current analysis, to provide a more complete portrait of the change over time in the frequency of the SEC’s issuance of these comment letters.

Chart #4: SEC Initial Correspondence Comment Letters from July 2021 to December 2024

As revealed by the chart, there was an initial spike in the issuance of comment letters pertaining to climate change coinciding with when the Sample Letter was first announced in 2021. Throughout 2022 and 2023, there were more modest peaks (around fifteen (15) letters in each), which were about half of the initial zenith in September 2021. By 2024, these peaks nearly dissipate entirely, which demonstrates a decrease in issuing comment letters relating to climate change even prior to the Trump administration taking office.

The chart also evidences that the spikes in the issuance of these comment letters seem to occur seasonally, mostly in the spring and summer months (May through October), while the issuance of comment letters almost stops entirely toward the end of each year (October through December). This increased influx of comment letters during the spring and summer months likely aligns with the typical public company reporting cycle, with most Form 10-Ks filed by late March, and the SEC’s comment letters later issued in response to those filings. Notably, the rate at which greenwashing-only letters have been issued has remained largely steady from March 2023 through October 2024, before dropping off at the end of 2024.

V. Entities Targeted by the SEC

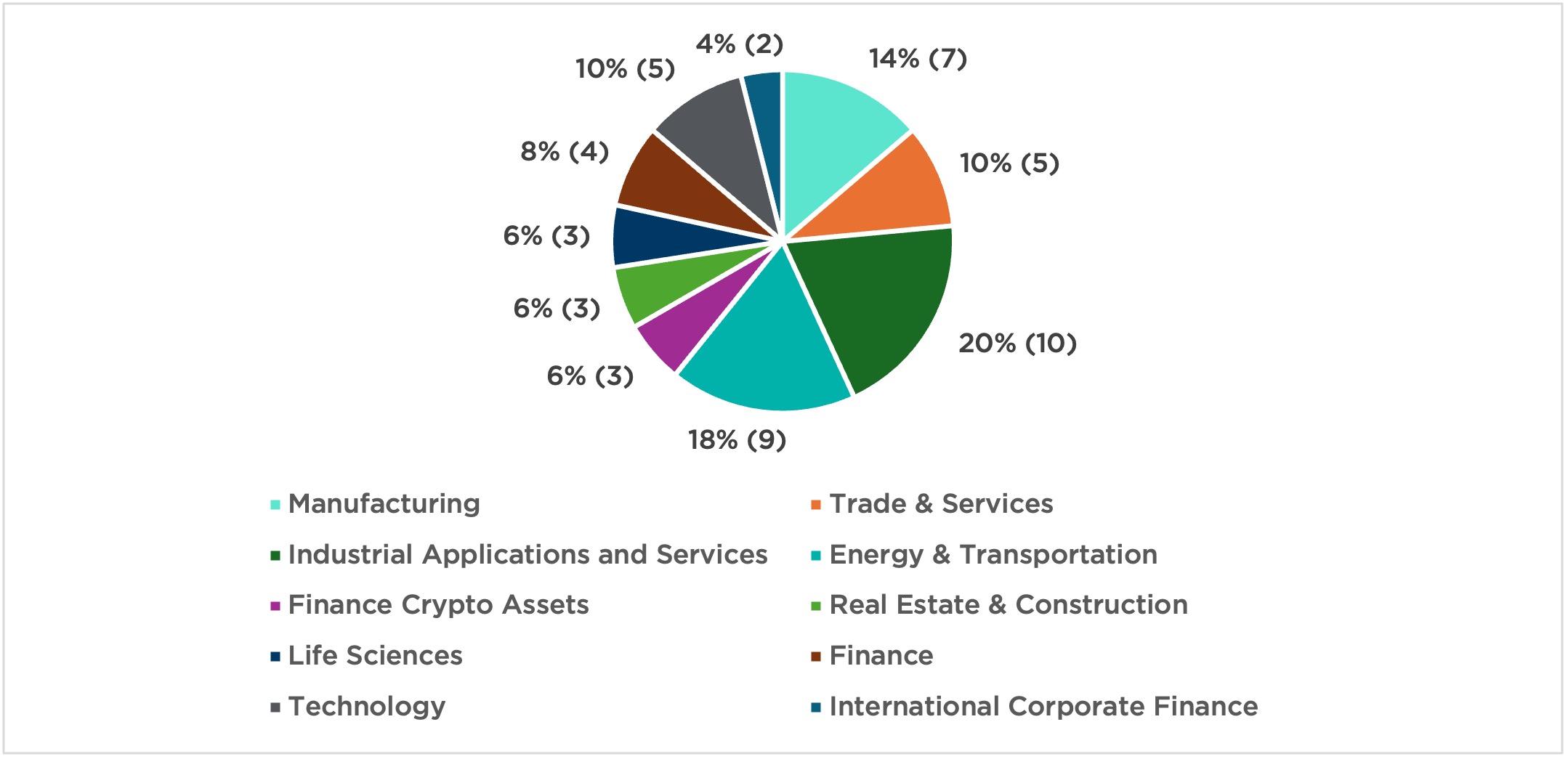

There have been some changes among the type of targeted entities in the last 21 months when compared to the earlier time period analyzed in the June 2023 Article, as demonstrated by the chart and table below. Notably, the industry of Structured Finance has effectively disappeared from the industry categories of Sample Letter recipients, which represented 16% of recipients in the June 2023 Article, while it is nonexistent at present. The industries of Energy & Transportation (18%) and Manufacturing (14%) still remain dominant categories, but as a whole, these are much more evenly distributed than the industry categories portrayed in the June 2023 Article. (Together, these categories now constitute 32% of all companies targeted; in the prior period, these two categories contained fully 64% of the companies targeted.) Significantly, though, there has also been a sharp rise in Industrial Applications and Services from just 1% in the prior period to 20% in the current period. Even so, based on this data, it appears that the SEC’s strong focus on particular industries has declined in recent years.

Chart #5: Industries of Sample Letter Recipients

Table #1: Comparison of Industry Recipients of Comment Letters Over Time

| July 2021 - March 2023 | April 2023 - December 2024 | ||||||

| Industry (SEC Office) | # of Companies | % | # Companies | % | |||

| Energy & Transportation | 31 | 33% | 9 | 18% | |||

| Finance | 5 | 5% | 4 | 8% | |||

| Finance Crypto Assets | 2 | 2% | 3 | 6% | |||

| Industrial Applications and Services | 1 | 1% | 10 | 20% | |||

| International Corp Fin | 1 | 1% | 2 | 4% | |||

| Life Sciences | 1 | 1% | 3 | 6% | |||

| Manufacturing | 29 | 31% | 7 | 14% | |||

| Real Estate & Construction | 2 | 2% | 3 | 6% | |||

| Structured Finance | 15 | 16% | 0 | 0% | |||

| Technology | 5 | 5% | 5 | 10% | |||

| Trade & Services | 3 | 3% | 5 | 10% | |||

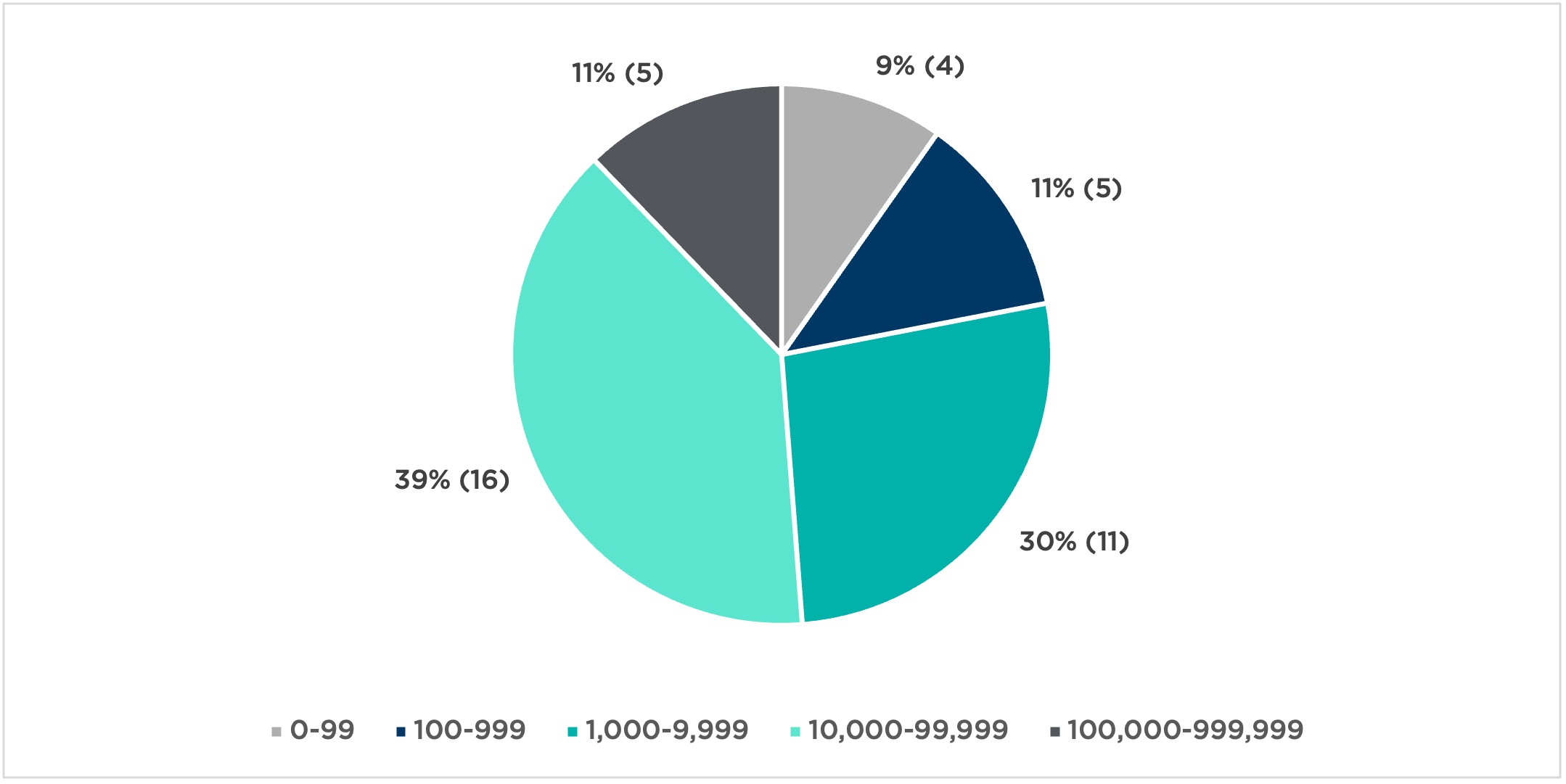

In contrast, with respect to market capitalization, the chart below remains largely similar to that of the June 2023 Article, with the largest number of recipients (sixteen (16), or 39%) having a market capitalization between $10,000,000 and $99,999,000, followed by those with a market capitalization between $1,000,000 and $9,999,000 (eleven (11), or 30%). (In the prior time period, these percentages were 42% and 32%, respectively.)

Chart #6: Market Capitalization of Sample Letter Recipients ($MM)

VI. Conclusion

Based upon our evaluation and analysis of the data, the SEC continues to maintain a strong interest in greenwashing, particularly in its examination of Investment Entities. While comment letters are still actively being used to monitor climate-related disclosures of companies, there has been a sharp decline in their use and a departure altogether from certain categories of questions that were previously the subject of significant interest, such as Litigation Risk, Capital Expenditures, Compliance Costs, and Transition Risk. As seen in Chart #4, there has been a significant drop in overall SEC comment letters since the start of 2024, and, unsurprisingly, it is likely that this decline in the number of climate-focused letters issued will persist into the coming years under the Trump administration and that the use of climate-focused comment letters by the SEC may potentially decrease even further.

Endnotes

[1] The review team used targeted climate change–related keywords to search EDGAR’s database (via EDGAR’s advanced text search) for all letters sent by the SEC within the date range of 2023-04-01 through 2024-12-31, containing questions that correspond to those listed in the SEC Sample Letter to Companies Regarding Climate Change Disclosures (the SEC Sample Letter). The team then recorded the types of comments received in each letter, the names of company recipients, the total number of comment letters received by each recipient, and other company-specific data for each recipient. This information is saved in a database, along with the letters themselves, which is available upon request. Our analysis in this article flows from our findings recorded in this database.

[2] For purposes of this analysis, we considered Investment Entities to constitute reporting entities that were funds, trusts, or vehicles solely focused on investing in other companies or assets that report pursuant to the Investment Company Act of 1940, identified as such by the Intelligize database, or both. Companies constituted all other reporting entities.

Authors

Jacob H. Hupart

Member

Anne L. Bruno

Member